White Paper

September 12, 2016, 12:43 PM EDT

The Value of Consumer Financing

DOWNLOADAuthor

David Liebskind

Abstract:

Table of Contents

Promotional financing can include one of many different types of promotions such as:

• No Interest for 24 Months (“equal pay no interest”),

• Reduced APR Promotions with Fixed Monthly Payments

• Installment Loans (not a revolving credit card account).

Value of Promotional Financing

One of the key findings from this study was that Synchrony Bank cardholders who used financing to make their purchase of at least $500 spent on average 35% more ($547) than non-cardholders surveyed.3

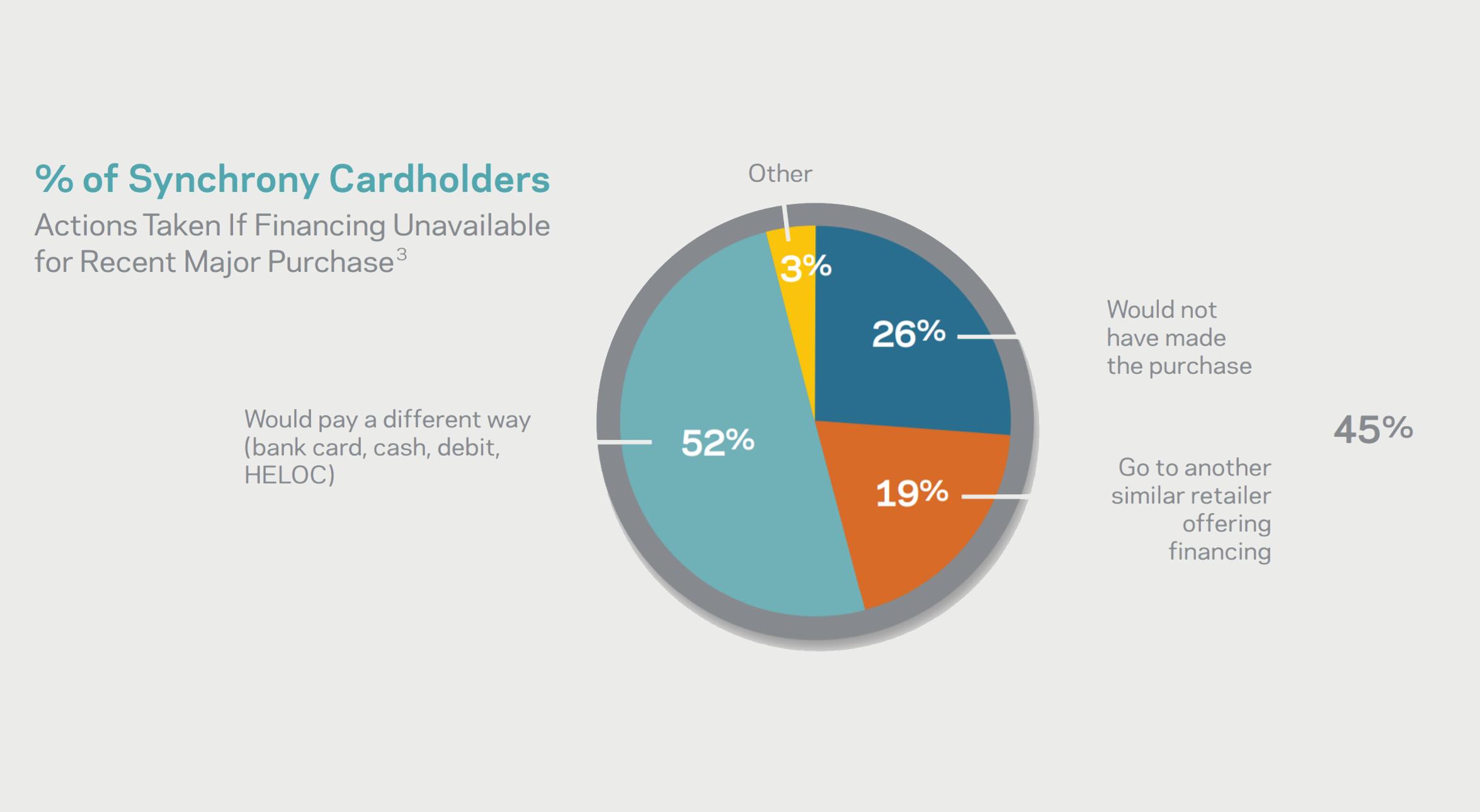

Consumers find significant value in using financing as a purchasing tool. In fact, 89% of Synchrony Bank cardholders surveyed stated that promotional financing makes their purchase more affordable.3 In addition, almost half of those surveyed stated that if financing were not available at the retailer when they made the purchase, they would have either abandoned the purchase or gone to another retailer.2 This data makes it clear that financing helps close the sale, drives customer loyalty and creates an opportunity to maintain/increase market share.

• Average ticket

• Repeat rate

• Sales per customer

Driver of Incremental Spend

• Customers purchasing in more categories. Customers with this added spending power may be more likely to make an additional purchase. For example, someone buying a new sofa may choose to add the coffee table to their purchase now that they are using promotional financing.4

Foot Traffic and Share

Three-fourths of Synchrony Bank cardholders surveyed say they “always” seek promotional financing offers when making a major purchase. Shoppers are clearly hunting for offers and value.3 In fact, over a third of shoppers say they look for financing on the retailer’s website3 and for the large majority (77% of Synchrony Bank cardholders) promotional financing influences their final choice of retailer.4

This is why it is critical to showcase promotional financing offers early, often and prominently throughout the retail website experience. It may also be important for retailers to offer the customer the choice of promotional financing options, empowering the customer and driving a potential competitive advantage over other retailers.

Promotional financing can also help drive an increase in market share. 45% of major purchase shoppers surveyed said they would not have made the purchase or would have gone to a similar retailer offering financing if promotional financing was not available at the time of their recent purchase.3

Elements Needed to Help Develop a Successful Program

• Monitoring the competition

• Advertising and offer strategy

• The role of your website and the associate

• Test and Learn/Key Success Metrics

Consumer Choice and Variety of Promo Durations

Research has also shown that offering a choice of two to three promotional financing offers (for example: No Interest if Paid in Full for 6 or 12 months) drives incremental consumer interest over featuring just one financing offer. For purchases up to $4,000, data suggests that consumers are looking for promotional financing terms anywhere between 12 and 24 months to pay off their purchase.7

In addition to financing, offering cardholders the choice of an immediate discount or a financing promotion for their purchase also can be appealing. This allows customers who don’t want to use promotional, longer-term financing to still realize a benefit by using their store card to make the purchase, while those who want financing can leverage that choice.

Monitoring The Competition

• What offers are they promoting during peak holidays and how are they pulsed throughout the year?

• How long do other retailers typically pulse offers and how does it differ by type of product being sold?

• What do they require for customers to be eligible to take advantage of promotional financing? Is it based on minimum purchase amount or are specific products featured?

Advertising and Signage

• Newspapers

• Websites

• Paid Search/Online Displays

• Radio/TV Spots

Creating awareness for the consumer can play an instrumental role in making the retailer the brand of choice. This can be particularly important during the holidays when multiple retailers are competing for share and trying to drive foot traffic to their stores.

Role of The Web and The Associate

• How does financing work for the consumer and what are the terms of payment?

• What minimum purchase amounts (or product types) are required to be eligible for financing?

• Overcome objections

• Communicate financing opportunities to all customers

Test and Learn/Key Success Metrics

• Conversion rate

• Product/category mix

• Number of items per order

• Average ticket

• Sales per customer

• Margin

.jpg)